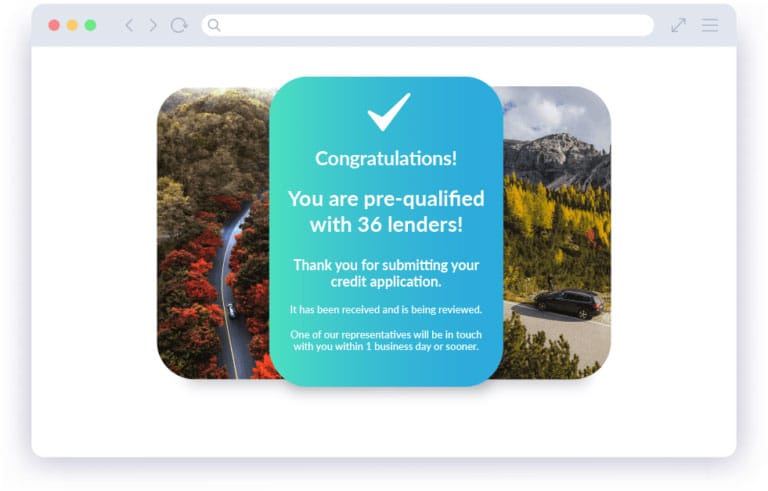

Are you dreaming of a new car but dreading the loan application process? At DDC Credit, we make it easy to prequalify for an auto loan without impacting your credit score. Our simple and secure online process takes just a few minutes, so you can get one step closer to hitting the open road in your dream car.

Auto loan pre-qualification is a quick and easy way to estimate how much you can borrow for a car loan. It involves providing basic information about your finances and credit history. Based on this information, lenders can give you an idea of the loan amount, interest rate, and terms you might qualify for.

Prequalifying for an auto loan is not a guarantee of approval, but it’s a valuable first step in the car buying process. It helps you:

Our online pre-qualification process is simple and secure:

Apply for a loan: Once you’ve found the right loan, you can proceed with a formal application.

It’s important to understand the difference between prequalification and preapproval:

While prequalification is a great starting point, preapproval gives you a more concrete idea of the loan you can secure.

Ready to Get Started? Prequalify for your auto loan today and take the first step towards owning your dream car! Our team is here to guide you through the process and answer any questions you may have.

The minimum credit score varies depending on the lender. However, a higher credit score generally increases your chances of prequalification and getting favorable loan terms.

With DDC Credit, you can get prequalified in just a few minutes.

No, our soft credit check will not impact your credit score.

No, prequalification is an estimate, while preapproval is a conditional loan offer.

You’ll need to provide basic information about your income, employment, and credit history.

Yes, you may still be able to prequalify with bad credit, but your loan options might be limited. We specialize in auto credit for everyone.

After prequalifying, you can compare offers from different lenders and choose the one that best suits your needs. You can then proceed with a formal loan application.

Improving your credit score, increasing your down payment, and having a stable income can all improve your chances of prequalification.

Once you’ve chosen a lender, you’ll need to complete a full loan application and provide additional documentation to finalize the loan. You can apply here.

Yes, you can explore refinancing options with DDC Credit.

Do you still have questions? Contact our team